what impact on luxury industry?

Translated by

Nicola Mira

Published

Jul 4, 2024

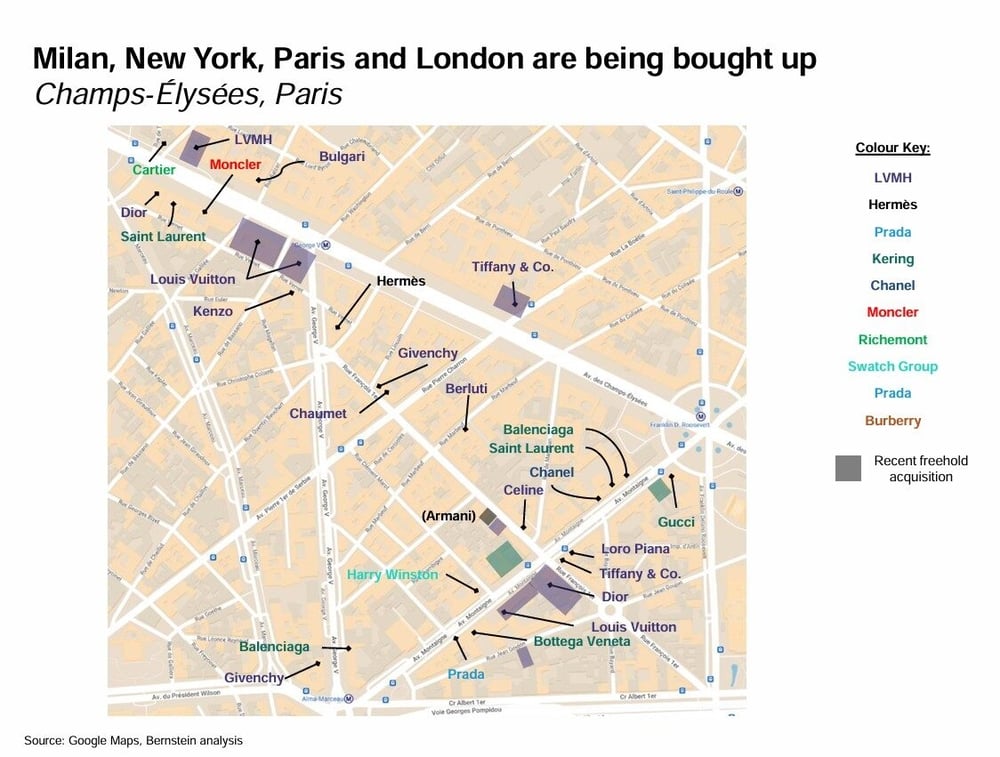

After vying for the largest, most sumptuous stores, the luxury industry is spending lavishly to grab the most prestigious property assets on the market. In the last five years, the luxury industry’s leading groups have invested nearly €10 billion in real estate, decidedly stepping on the gas in the last 18 months. Such extravagant real estate spending isn’t without consequences, for the market and for the corporations themselves, as shown by consulting firm Bernstein in the ‘Luxury Retail Evolution, Store Wars’ study, conducted for Altagamma, the association of Italy’s top luxury labels.

The Bernstein reported indicated that, between 2020 and 2024, Hermès has invested €200 million in property, Chanel invested €500 million, Prada €800 million, notably buying a building on New York’s Fifth Avenue in December 2023, LVMH has invested €3.4 billion, including €1 billion last December for the building at 150 avenue des Champs-Elysée in Paris, and Kering invested €4 billion, its latest purchase, announced in April, a palazzo in via Montenapoleone in Milan.

Making investments of this magnitude could have a damaging impact on smaller-sized groups, warned Luca Solca, the study’s author. According to Bernstein’s calculations, the €3.2 billion invested in real estate by LVMH between 2022 and 2023 accounted for 14% of its free cash flow. For less sizeable groups, like Kering, which invested €1.8 billion in the same period, or Prada, which forked out €800 million, these sums’ incidence on cash flow was much more significant, at 35% and 59% respectively.

“This means having fewer resources that can be allocated to growing the brand, to spend on manufacturing facilities and other operational investment. It also has an impact on debt. Besides, such extensive real estate investment ties up the groups’ capital without significant returns, yielding 2%-3% maximum per year. This in turn depresses ROI, diluting it, with the risk of triggering a share price decline and a slump in the group’s valuation, exposing the company to a greater risk of being acquired,” said Solca.

The other result of this real estate rush is that it has concentrated on only one commercial thoroughfare in each of the world’s fashion capitals, except in Paris, where the Champs-Elysées have been a focus alongside avenue Montaigne (chiefly favoured by LVMH labels). A phenomenon clearly visible in Milan, where via Montenapoleone has stolen a march on via della Spiga, the Lombardy city’s other long-established luxury shopping street, and in New York, where Fifth Avenue has replaced Madison Avenue.

As a result, smaller-sized labels, even if they are just as renowned as the top luxury giants, are set to drop out of the race for the most prestigious luxury shopping streets, incapable as they are to rival with such large-scale investment.

Yet Solca sees this phenomenon also as an opportunity, since the magnitude of the investments would prevent smaller labels from mistakenly entering this kind of race. Solca also hinted at ways in which these labels could hold out, and even hit back. “The best thing to do seems to be to regroup and return to areas that have been neglected lately, like via della Spiga in Milan, and Madison Avenue in New York,” he advised.

Another recommendation is to try to outsmart the competition by spotting locations that could become attractive in the near future, as Moncler did a few years ago by opening a store on the Champs-Élysées, where it now finds itself in excellent company. A third idea is to invest in luxury flats, far less costly than properties with street-side premises, where labels can create exclusive retail spaces well-suited to their most affluent customers.

Copyright © 2024 FashionNetwork.com All rights reserved.