Direct Indexing: Growing Investment Strategy Among The Wealthy

One of the investing strategies growing in popularity with the wealthy is Direct Indexing. Before my consulting stint at a fintech startup in 2024, I had never really heard of Direct Indexing. If I did, I likely assumed it simply meant directly investing in index funds, which many of us already do.

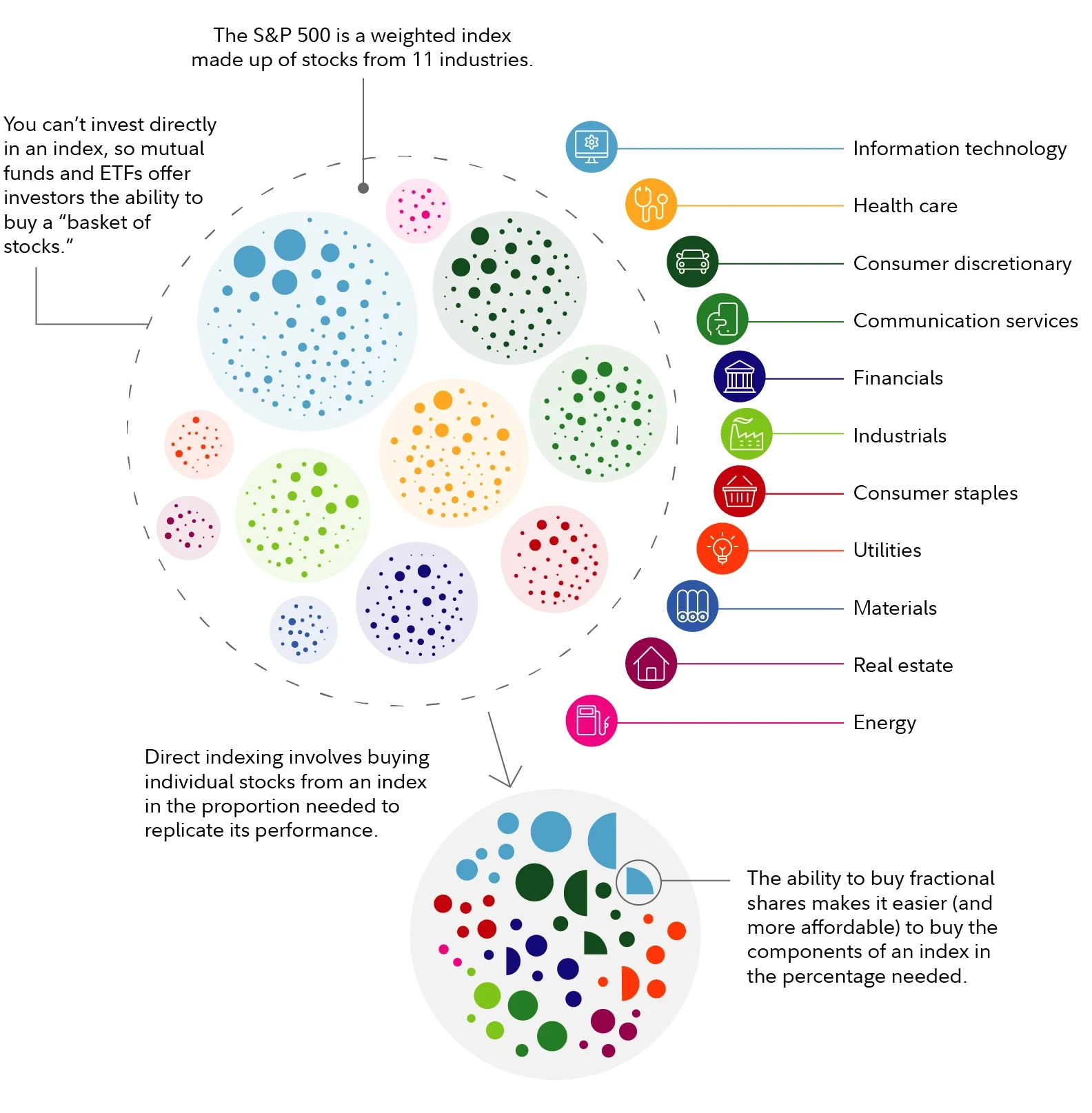

However, Direct Indexing is more than just buying index funds. It is an investment strategy that allows investors to purchase individual stocks that make up an index rather than buying a traditional index fund or exchange-traded fund (ETF). This approach enables investors to directly own a customized portfolio of the actual securities within the index, providing greater control over the portfolio’s composition and tax management.

Let’s look at the benefits and drawbacks of Direct Indexing to get a better understanding of what it is. In a way, Direct Indexing is simply a new way to package and market investment management services to clients.

Benefits of Direct Indexing

- Personalization: Direct Indexing allows you to align your portfolio with your specific values and financial goals. For example, you can exclude all “sin stocks” from your portfolio if you wish.

- Tax Optimization: This strategy offers opportunities for tax-loss harvesting that may not be available with traditional index funds. Tax-loss harvesting helps minimize capital gains tax liability, thereby boosting potential returns.

- Control: Investors have more control over their investments, allowing them to manage their exposure to particular sectors or companies. Instead of following the S&P 500 index managers’ decisions on company selection and weighting, you can set sector weighting limits, for example.

Drawbacks of Direct Indexing

- Complexity: Managing a portfolio of individual stocks is more complex than investing in a single fund. Therefore, most investors don’t do it themselves but pay an investment manager to handle it, which leads to additional fees.

- Cost: The management fees and trading costs associated with Direct Indexing can be higher than those of traditional index funds or ETFs, although these costs may be offset by tax benefits.

- Minimum Investment: Direct Indexing often requires a higher minimum investment, making it less accessible for some investors.

- Performance Uncertainty: It’s hard to outperform stock indices like the S&P 500 over the long term. The more an investor customizes with Direct Indexing, potentially, the greater the underperformance over time.

Who Should Consider Direct Indexing?

Direct indexing is particularly suited for high-net-worth individuals, those in higher tax brackets, or investors seeking more control over their portfolios and willing to pay for the customization and tax benefits it offers.

For example, if you are in the 37% marginal income tax bracket, face a 20% long-term capital gains tax, and have a net worth of $20 million, you might have strong preferences for your investments. Suppose your parents were addicted to tobacco and both died of lung cancer before age 60; as a result, you would never want to own tobacco stocks.

An investment manager could customize your portfolio to closely follow the S&P 500 index while excluding all tobacco and tobacco-related stocks. They could also regularly conduct tax-loss harvesting to help minimize your capital gains tax liability.

However, if you are in a tax bracket where you pay a 0% capital gains tax rate and don’t have specific preferences for your investments, direct indexing may not justify the additional cost.

This scenario is similar to how the mortgage interest deduction was more advantageous for those in higher tax brackets before the SALT cap was enacted in 2018. Whether the SALT cap will be repealed or its $10,000 deduction limit increased remains to be seen, especially given its disproportionate impact on residents of high-cost, high-tax states.

More People Will Gain Access to Direct Indexing Over Time

Thankfully, you don’t need to be worth $20 million to access the Direct Indexing strategy. If you’re part of the mass affluent class with $250,000 to $2 million in investable assets, you already have enough. As more fintech companies expand their product offerings, even more investors will be able to access Direct Indexing.

Just as trading commissions eventually dropped to zero, it’s only a matter of time before Direct Indexing becomes widely available to anyone interested. Now, if only real estate commissions could hurry up and also become more reasonable.

Which Investment Managers Offer Direct Indexing

So you believe in the benefits of Direct Indexing and want in. Below are the various firms that offer Direct Indexing services, the minimum you need to get started, and the starting fee.

As you can see, the minimum investment amount to get started ranges from as low as $100,000 at Charles Schwab and Fidelity to $250,000 at J.P. Morgan, Morgan Stanley, and other traditional wealth manages.

Meanwhile, the starting fee ranges between 0.20% to 0.4%, which may get negated by the additional investment return projected through direct indexing tax management. The fee is usually on top of the cost to hold an index fund or ETF (minimal) or stock (zero).

Now that we’re aware of the variety of firms offering Direct Indexing, let’s delve deeper into the tax management aspect. The benefits of personalization and control are straightforward: you set your investment parameters, and your investment managers will strive to invest according to those guidelines.

Understanding Tax-Loss Harvesting

Tax-loss harvesting is a strategy designed to reduce your taxes by offsetting capital gains with capital losses. The greater your income and the wealthier you get, generally, the greater your tax liability. Rationally, all of us want to keep more of our hard-earned money than giving it away to the government. And the more we disagree with the government’s policies, the more we will want to minimize taxes.

Basic tax-loss harvesting is relatively simple and can be done independently. As your income increases, triggering capital gains taxes—more advanced techniques become available, often requiring a portfolio management fee.

Basic Tax-Loss Harvesting

Each year, the government allows you to “realize” up to $3,000 in losses to reduce your taxable income. This reduction directly decreases the amount of taxes you owe.

For example, if you invested $10,000 in a stock that depreciated to $7,000, you could sell your shares at $7,000 before December 31st to reduce your taxable income by $3,000. You can carry over $3,000 in annual losses until it is exhausted.

Anybody who does their own taxes or has someone do their taxes for you can easily conduct basic tax-loss harvesting.

Advanced Tax-Loss Harvesting

Advanced tax-loss harvesting, however, is slightly more complicated. It can’t be used to reduce your income directly, but it can be applied to reduce capital gains taxes.

For instance, if you bought a stock for $100,000 and sold it for $150,000, you would have a realized capital gain of $50,000. This gain would be subject to taxes based on your holding period:

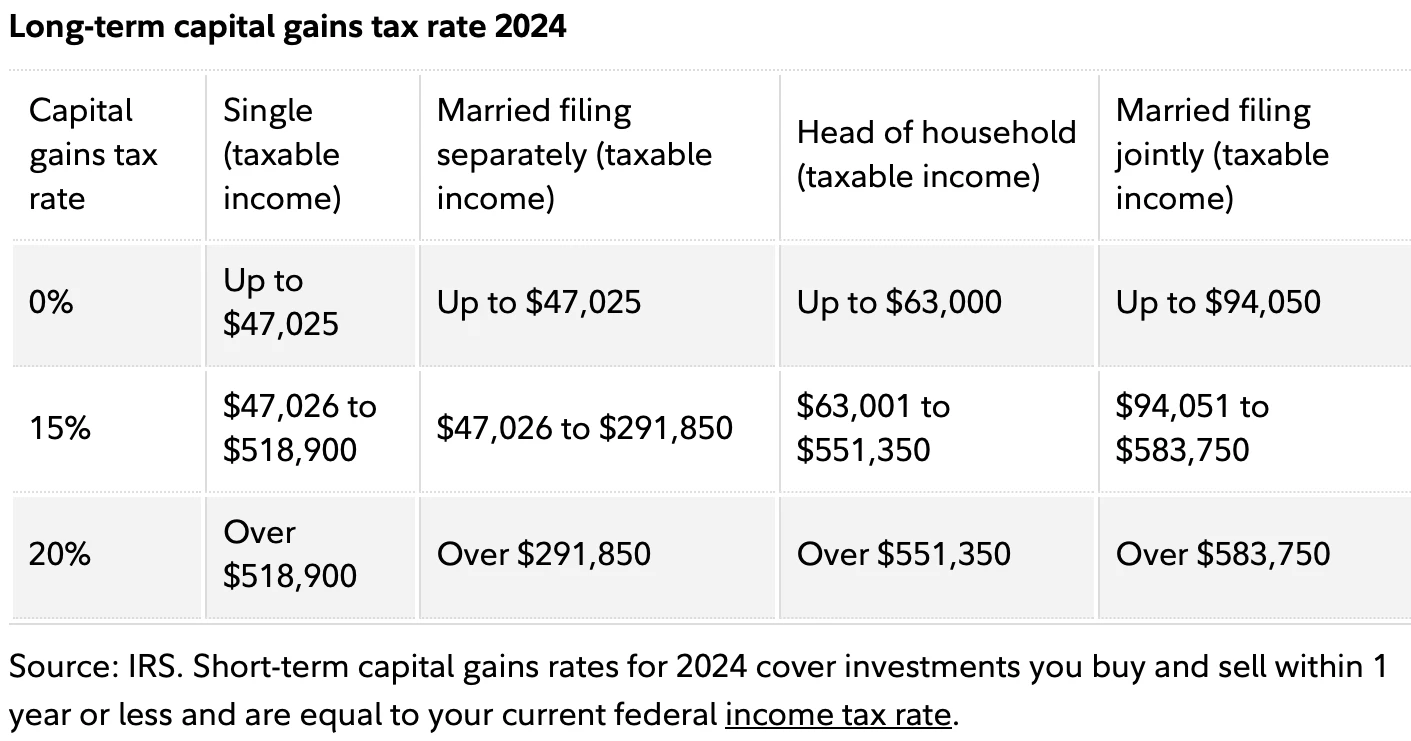

- Short-term capital gains: If the stock was held for less than a year, the gain would be taxed at your marginal federal income tax rate, which is the same rate as your regular income.

- Long-term capital gains: If the holding period exceeds one year, the gain would be taxed at a lower long-term capital gains rate, which is generally more favorable than your marginal rate.

To mitigate capital gains taxes, you can utilize tax-loss harvesting by selling a stock that has declined in value to offset the gains from a stock that has appreciated. There is no limit on how much in gains you can offset with realized losses. However, once you sell a stock, you must wait 30 days before repurchasing it to avoid the “wash sale” rule.

When To Use Tax-Loss Harvesting

In the example above, to offset $50,000 in capital gains, you would need to sell securities at a loss within the same calendar year. The deadline for realizing these losses is December 31st, ensuring they can offset capital gains for that specific year.

For instance, if you had $50,000 in capital gains in 2023, selling stocks in 2024 with $50,000 in losses wouldn’t eliminate your 2023 gains. The capital gains tax would still apply when filing your 2023 taxes. To offset the gains in 2023, you would have needed to sell stocks in 2023 with $50,000 in losses.

However, let’s say you had $50,000 in capital gains after selling stock in 2024. Even if you didn’t incur any capital losses in 2024, you could use capital losses from previous years to offset those gains.

Maintaining accurate records of these losses is crucial, especially if you’re managing your own investments. If you hire an investment manager, they will track and apply these losses for you.

Crucial Point: Capital Losses Can Be Carried Forward Indefinitely

In other words, capital losses can be carried forward indefinitely to offset future capital gains, provided they haven’t already been used to offset gains or reduce taxable income in prior years.

During several years in my 20s, I was unaware of this. I mistakenly believed that I could only carry over a $3,000 loss to deduct against my income each year. As a result, I paid thousands of dollars in capital gains taxes that I didn’t need to pay. If I had a wealth manager to assist me with my investments, I would have saved a significant amount of money.

While the ideal holding period for stocks may be indefinite, selling occasionally can help fund your desired expenses. Tax-loss harvesting aims to minimize capital gains taxes, enhancing your overall return and providing more post-tax buying power.

The higher your income tax bracket, the more beneficial tax-loss harvesting becomes.

Tax Bracket Impact And Direct Indexing

Your marginal federal income tax bracket directly influences your tax liability. Shielding your capital gains from taxes becomes more advantageous as you move into higher tax brackets.

For instance, if your household income is $800,000 (top 1% income), placing you in the 37% federal marginal income tax bracket, a $50,000 short-term capital gain from selling Google stock would result in an $18,500 tax liability. Conversely, a $50,000 long-term capital gain would be taxed at 20%, amounting to a $10,000 tax liability.

Now, let’s say your married household earns a middle-class income of $80,000, placing you in the 12% federal marginal income tax bracket. A $50,000 short-term capital gain from selling Google stock would incur an $11,000 tax liability—$7,500 less than if you were making $800,000 a year. Meanwhile, a $50,000 long-term capital gain would be taxed at 15%, or $7,500.

In general, try to hold securities for longer than a year to qualify for the lower long-term capital gains tax rate. As the examples illustrate, the higher your income, the greater your tax liability, making direct indexing and its tax management strategies more beneficial.

Below are the income thresholds by household type for long-term capital gains tax rates in 2024.

Restrictions and Rules for Tax-Loss Harvesting

Hopefully, my examples explain the benefits of tax-loss harvesting. For big capital gains and losses, tax-loss harvesting makes a lot of sense to improve returns. I’ll always remember losing big bucks on my investments, and using those losses to salvage any future capital gains.

However, tax-loss harvesting can get complicated very quickly if you engage in many transactions over the years. By December 31st, you need to decide which underperforming stocks to sell to offset capital gains and minimize taxes. This is where having a wealth advisor managing your investments becomes more beneficial.

For do-it-yourself investors, the challenge lies in the time, skills, and knowledge needed for effective investing. If you plan to engage in tax-loss harvesting, let’s recap the essentials to make things crystal clear.

Annual Tax Deduction Carryover Limit is $3,000

- If you have $50,000 in capital losses and $30,000 in total capital gains for the year, you can use $30,000 in capital losses to offset the corresponding gains, leaving you with $20,000 in remaining capital loss.

- You can carry over the remaining $20,000 in losses indefinitely to offset future gains. In years without capital gains, you can use your capital loss carryover to deduct up to $3,000 a year against your income until it is exhausted.

No Expiration Date on Capital Losses

- If you have $90,000 in capital losses from selling stocks during a bear market and zero capital gains that year, you can carry those losses forward to offset future income or capital gains. Fortunately, capital losses never expire.

The Wash Sale Rule Nullifies Tax-Loss Harvesting Benefits

- A loss is disallowed if, within 30 days of selling the investment, you or your spouse reinvest in an identical or “substantially similar” stock or fund.

Losses Must First Offset Gains of the Same Type

- Short-term capital losses must first offset short-term capital gains, and long-term capital losses must offset long-term gains. If losses exceed gains, the remaining capital-loss balance can offset personal income up to a limited amount. For detailed advice, consult a tax professional.

Direct Indexing Conclusion

Personalization, control, and tax optimization are the key benefits of Direct Indexing. With this approach, you don’t have to invest in sectors or companies that don’t align with your beliefs. Nor do you have to blindly follow the sector weightings of an index fund or ETF as they change over time. This represents the personalization and control aspects of Direct Indexing.

If you’re focused on return optimization, the tax-loss harvesting feature of Direct Indexing is most attractive. According to researchers at MIT and Chapman University, tax-loss harvesting yielded an additional 1% annual return on average from 1928 to 2018. Even if Direct Indexing costs up to 0.4% annually, the benefits of tax-loss harvesting still outweigh the cost.

The best way to avoid paying capital gains taxes is to refrain from selling. Borrow from your assets like billionaires to pay less taxes. However, when you need to sell stocks to enhance your life, remember the advantages of tax-loss selling, as it can significantly reduce your tax liabilities.

Direct Indexing offers a compelling way to optimize returns through tax-loss harvesting and portfolio customization. As tax laws become more complex and investors seek ways to align their portfolios with personal values, Direct Indexing provides a powerful tool for both advanced and everyday investors.

Reader Questions

Have you used the strategy of Direct Indexing before? Was this the first time you’ve heard of it? Do you think the benefits of tax-loss harvesting justify the additional fees associated with Direct Indexing? I believe that eventually, Direct Indexing will become available to a broader audience at a lower cost.

With stock market volatility returning and a potential recession looming, it’s more important than ever to get a financial checkup. Empower is currently offering a free financial consultation with no obligation for a limited time.

If you have over $250,000 in investable assets, don’t miss this opportunity. Schedule an appointment with an Empower professional here. Complete your two video calls with the advisor before October 31, 2024, and you’ll receive a free $100 Visa gift card. There is no obligation to use their services after.

Empower offers a proprietary indexing methodology called Smart Weighting to its clients. Smart Weighting samples individual U.S. stocks to create an index that equally weights economic sector, style, and size. The goal is to achieve a better risk-adjusted return.

The statement is provided to you by Financial Samurai (“Promoter”) who has entered into a written referral agreement with Empower Advisory Group, LLC (“EAG”). Click here to learn more.