Cash-Flush Florida Seeks to Retire $1.7 Billion of Debt and Prepare for Storms

Cash-Flush Florida Seeks to Retire $1.7 Billion of Debt and Prepare for Storms

Municipal bonds sold by the state of Florida are poised to become much scarcer.

That’s because Governor Ron DeSantis plans to pay down $1.7 billion of tax-supported debt as part of his budget proposal for the fiscal year that begins in July. The spending plan — dubbed the “Focus on Fiscal Responsibility Budget” — builds on his existing debt-reduction program.

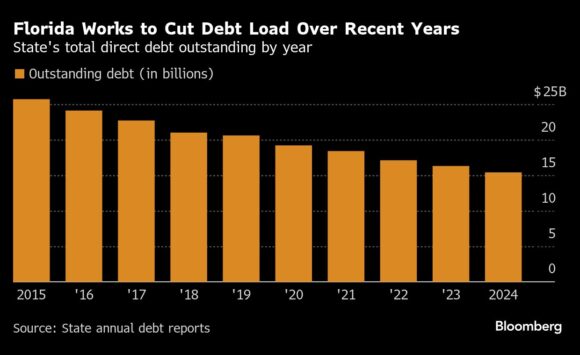

Florida has been paring its liabilities for years and DeSantis has made it a priority since he took office in 2019. The state had roughly $15.4 billion of direct debt outstanding at the end of the last fiscal year, according to an annual debt report prepared by the Division of Bond Finance. That’s a 40% drop since 2015, the data shows. Direct debt includes tax-backed bonds and those secured by self-sustaining revenue like highway tolls.

DeSantis has proposed allocating an additional $830 million in next year’s budget to retire outstanding bonds, with a portion earmarked for debt that supported Everglade restoration. Those funds supplement the $870 million of already-scheduled debt payments slated for next year, according to Ben Watkins, the state’s director of bond finance.

Less debt means the state can reduce some of its fixed costs, like paying out interest and principal to bondholders each year. That frees up future spending that Florida can either store away or invest in other priorities.

“That leaves them more financial flexibility to respond to other needs that may arise, like if they were to be hit with another major hurricane,” said Denise Rappmund, vice president at Moody’s Ratings. Florida has top-tier credit ratings from Moody’s, S&P Global Ratings and Fitch Ratings.

Revenue Growth

DeSantis included a bevy of investments in his proposed budget, including giving some first responders a 25% pay bump and spending nearly $30 billion on K-12 education. His plans include having $14.6 billion in reserves. Maintaining reserves is a priority so that Florida “can effectively respond to storms and unforeseen disasters,” his proposal said.

Nationwide, state liabilities have been declining broadly because of pandemic-era federal aid and strong revenue growth — a trend Florida has benefited from. The state doesn’t levy an income tax, so it is more reliant on sales-tax revenues, which have been robust as prices increased due to inflation.

“They were already growing in terms of population, but through that pandemic period it surged more than in other states, said Rappmund. “They reaped the benefits of that.”

The state is estimating just over $50 billion of general revenue in the upcoming fiscal year, roughly 0.8% more than last year, according to the budget proposal.

Last year, as part of the debt-reduction program, Florida offered to buy back about $500 million of its outstanding bonds in a first-ever cash tender offer. Watkins said that buy back saved the state more than $200 million.

Read More: Cash-Flush Florida Tries to Buy Back Its Bonds for First Time

“Florida’s steadfast commitment to fiscal conservatism is why we are in such good financial shape,” said DeSantis in a statement on Monday.

Florida also has the ability to issue more debt, should it need to do so. The state has roughly $31 billion of debt capacity in fiscal year 2025, the state’s debt report said.

“The takeaway for policymakers is that significant debt capacity is available should debt be needed to accelerate strategically important infrastructure projects,” according to the December report.

The governor’s budget proposal is the first step in negotiating the upcoming spending plan. The state’s regular legislative session begins March 4 and lawmakers will draft a budget bill that is likely to be adjusted.

Copyright 2025 Bloomberg.

Interested in Windstorm?

Get automatic alerts for this topic.